Table of Contents

ToggleThe Power of AI

Artificial intelligence (AI) is rapidly transforming our world, with applications in a wide range of industries, from healthcare to finance to transportation. AI is able to perform tasks that were once thought to be the exclusive domain of humans, such as recognizing faces, understanding natural language, and making complex decisions.

One of the most powerful aspects of AI is its ability to learn from data. AI algorithms can be trained on large amounts of data to identify patterns and make predictions. This ability to learn is what allows AI to be used for such a wide variety of tasks.

For example, AI is being used to develop new drugs, diagnose diseases, and even design self-driving cars. AI is also being used to improve customer service, personalize marketing campaigns, and automate tasks.

The potential of AI is immense, and we are only just beginning to scratch the surface of what it can do. AI has the potential to solve some of the world’s most pressing problems, and it is sure to have a profound impact on our lives in the years to come.

AI vs Deep Learning vs ML

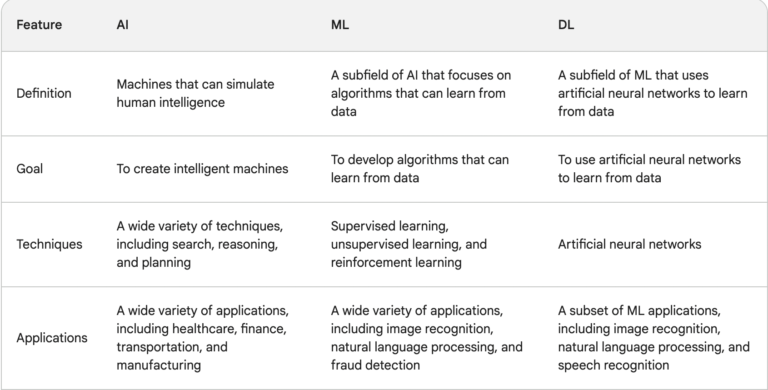

Artificial intelligence (AI), machine learning (ML), and deep learning (DL) are all related fields, but they have distinct differences.

- AI is the broader concept of machines that can simulate human intelligence.

- ML is a subfield of AI that focuses on algorithms that can learn from data.

- DL is a subfield of ML that uses artificial neural networks to learn from data.

In simpler terms, AI is the goal, ML is the method, and DL is a specific technique used in ML.

Here is a table that summarizes the key differences between AI, ML, and DL:

Tech Giants Investing Heavily in AI

Tech leaders like Satya Nadella, Sundar Pichai, and Jeff Bezos are investing heavily in AI for several reasons:

1. Potential for massive growth and innovation: AI has the potential to revolutionize industries and create entirely new markets. For example, AI is being used to develop new drugs, diagnose diseases, and even design self-driving cars. This has the potential to create trillions of dollars in new economic value.

2. Competitive advantage: AI is becoming increasingly important for businesses to stay competitive. Companies that can harness AI to improve their products, services, and operations will have a significant edge over their competitors.

3. Cost savings: AI can be used to automate tasks, reduce errors, and optimize processes. This can lead to significant cost savings for businesses.

4. Improved customer experience: AI can be used to personalize customer experiences, provide better customer service, and identify new customer needs. This can lead to increased customer loyalty and revenue.

5. Future-proofing: AI is a rapidly developing field, and businesses that invest in AI today will be well-positioned to take advantage of future breakthroughs.

Here are some examples of how tech giants are using AI to innovate and gain a competitive advantage:

Microsoft: Microsoft is using AI to develop new features for its productivity apps, such as Microsoft Office and Microsoft Teams. AI is also being used to improve the security of Microsoft’s products and services.

Google: Google is using AI to power its search engine, translate languages, and develop new products, such as Google Assistant and Google Maps. AI is also being used to improve the advertising business of Google.

Amazon: Amazon is using AI to recommend products to customers, personalize their shopping experience, and automate customer service. AI is also being used to optimize logistics and warehouse operations.

As AI continues to develop, we can expect to see even more innovative applications and even greater investment from tech giants. AI has the potential to transform our world in many ways, and we are only just beginning to see the possibilities.

Why Should We Invest In AI?

Investing in AI is a promising strategy for investors seeking long-term growth and exposure to a rapidly evolving sector with the potential to transform various industries. Here are some compelling reasons to consider investing in AI:

1. Disruptive Potential: AI is poised to revolutionize various industries, from healthcare and finance to manufacturing and transportation. Its ability to automate tasks, analyze vast amounts of data, and make predictions makes it a game-changer for businesses across sectors. As AI adoption grows, companies that harness its power will gain a significant competitive advantage, leading to increased profitability and market share.

2. Diverse Investment Opportunities: AI is not a single company or technology; it’s a broad field with numerous applications and subsectors. This presents a wide range of investment opportunities, allowing investors to diversify their portfolios and mitigate risk by investing in various AI-related companies and technologies.

3. Growing Market Size: The global AI market is expected to reach a staggering $1.6 trillion by 2025, driven by increasing demand for AI solutions across industries. This immense market size indicates the vast potential for companies developing and implementing AI technologies, making it an attractive investment opportunity for those seeking long-term growth.

4. Publicly Traded AI Companies: Several publicly traded companies are at the forefront of AI development and adoption. These companies offer investors direct exposure to the growth of AI, allowing them to participate in the potential profits generated by these innovative businesses. Examples include Microsoft, Google, Amazon, IBM, and Nvidia.

5. Venture Capital Investments: Venture capitalists are heavily investing in early-stage AI startups, recognizing the transformative potential of these companies. This influx of capital is fueling innovation and accelerating the development of new AI applications. Investors can also participate in this ecosystem by investing in venture capital funds with a focus on AI startups.

6. Future-Proofing Your Portfolio: AI is not just a fad; it’s a transformative technology that is rapidly changing the world. By investing in AI, you are positioning your portfolio to benefit from this ongoing revolution. As AI becomes more ubiquitous, its impact will only grow, making it a wise long-term investment.

Note: Remember, investing in AI carries inherent risks, as with any investment. Thorough research, careful consideration of risk tolerance, and diversification are crucial for successful AI investing.

Framework For Investing

1. Research: Before investing in any company, it is essential to conduct thorough research to understand the company’s business model, products or services, competitive landscape, financial performance, and management team. This research should involve analyzing the company’s financial statements, reading industry reports, and conducting interviews with industry experts.

Key aspects to consider during research include:

Market size and growth potential: Assess the size of the market the company operates in and its potential for growth. Identify the factors driving market growth and the company’s ability to capture market share.

Product or service viability: Evaluate the company’s product or service, its uniqueness, and its ability to address a specific customer need or pain point. Assess the competitive landscape and the company’s differentiation from rivals.

Financial performance: Analyze the company’s financial statements, including revenue, profitability, and cash flow. Identify trends in financial performance and assess the company’s financial sustainability.

Management team: Evaluate the experience, track record, and expertise of the company’s management team. Assess their ability to lead the company through growth and challenges.

2. Regulation: Understanding the regulatory environment in which the company operates is crucial for assessing potential risks and opportunities. Regulatory compliance is essential for businesses, and any regulatory changes or challenges could significantly impact the company’s operations and financial performance.

Key aspects to consider in regulation include:

Industry-specific regulations: Identify the specific regulations that govern the company’s industry and assess the company’s compliance with these regulations.

Intellectual property protection: Evaluate the company’s intellectual property portfolio, including patents, trademarks, and copyrights, and assess its ability to protect its intellectual assets.

Data privacy regulations: Assess the company’s adherence to data privacy regulations, such as GDPR and CCPA, and its ability to protect customer data.

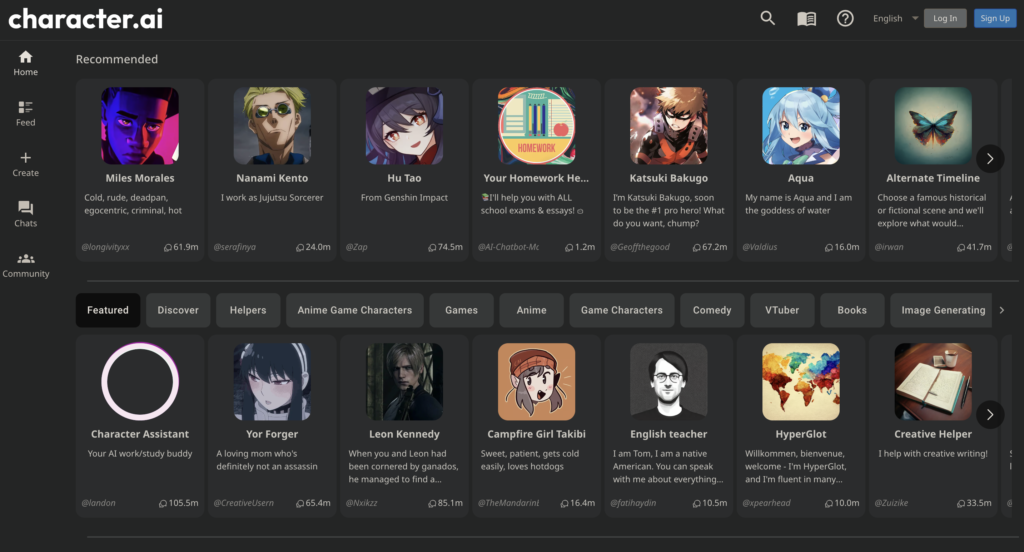

3. Customer/User Application/PMF (Product-Market Fit): Understanding the company’s customer base and its ability to attract and retain customers is essential for evaluating its long-term viability. Assess the company’s target customer segments, its customer acquisition strategies, and its customer satisfaction metrics.

Key aspects to consider in customer/user application/PMF include:

Target customer segments: Identify the company’s target customer segments and assess the size and potential of these segments.

Customer acquisition strategies: Evaluate the company’s marketing strategies, sales channels, and pricing strategies for customer acquisition.

Customer satisfaction metrics: Assess the company’s customer satisfaction metrics, such as churn rate, customer lifetime value, and Net Promoter Score (NPS).

4. Legal (Lawsuits) that Company Can Handle: Assessing the company’s legal exposure and its ability to handle potential lawsuits is crucial for mitigating risk. Evaluate the company’s involvement in any ongoing or pending lawsuits, its history of legal disputes, and its legal team’s capabilities.

Key aspects to consider in legal aspects include:

Ongoing or pending lawsuits: Identify any ongoing or pending lawsuits against the company and assess the potential impact of these lawsuits on its financial performance and reputation.

History of legal disputes: Evaluate the company’s history of legal disputes and its ability to resolve these disputes effectively.

Legal team capabilities: Assess the experience and expertise of the company’s legal team and its ability to handle complex legal matters.

5. Path to Profitability: Evaluating the company’s path to profitability is essential for assessing its long-term financial viability. Assess the company’s revenue growth, cost structure, and profitability margins.

Key aspects to consider in the path to profitability include:

Revenue growth: Assess the company’s historical revenue growth rate and its potential for future revenue growth.

Cost structure: Evaluate the company’s cost structure, including its operating expenses, capital expenditures, and cost of goods sold.

Profitability margins: Assess the company’s profitability margins, such as gross margin, operating margin, and net profit margin.

Top 5 Best Picks by Experts for Investing in AI

Top 5 AI Investment Picks:

- Nvidia (NVDA)

- Microsoft (MSFT)

- Amazon (AMZN)

- Meta (META)

- Jio Finance

Here are the reasons why you should consider investing in these companies, which are all leaders in the AI space:

Nvidia:

AI-Powered Graphics Processing Units (GPUs): Nvidia is a leading provider of GPUs, which are the essential hardware for training and running AI models. As AI adoption grows, the demand for GPUs is expected to increase significantly, making Nvidia a strong investment opportunity.

Diversified AI Business: Nvidia’s AI business extends beyond GPUs to include software platforms, cloud services, and AI applications. This diversification reduces reliance on a single product and increases the company’s overall growth potential.

Strong Financial Performance: Nvidia has consistently demonstrated strong financial performance, with revenue and profitability growing at a rapid pace. The company’s strong financial position supports its continued investment in AI innovation.

Microsoft:

AI-Powered Software and Cloud Services: Microsoft offers a wide range of AI-powered software products, including Azure AI, Microsoft Teams, and Power BI. The company’s cloud computing platform, Azure, is also a key driver of AI adoption.

Deep Expertise in AI Research: Microsoft has a deep commitment to AI research, with several research labs and a strong track record of innovation. This expertise is essential for developing cutting-edge AI technologies.

Large and Diversified Customer Base: Microsoft has a vast and diverse customer base that spans various industries, providing a strong foundation for AI adoption.

Amazon:

AI-Powered Retail and Logistics: Amazon is using AI to optimize its retail operations, from product recommendations to warehouse management. The company’s investments in AI are expected to drive further growth and efficiency.

AI-Powered Advertising and Cloud Services: Amazon’s advertising business and cloud computing platform, AWS, are also benefiting from AI adoption. The company’s expertise in AI is enabling it to provide more personalized and relevant services to its customers.

Strong Leadership and Innovation Culture: Amazon is known for its strong leadership and culture of innovation, which are critical for success in the rapidly evolving AI space.

Meta:

AI-Powered Social Media and Content Platforms: Meta is using AI to improve the user experience on its social media platforms, such as Facebook, Instagram, and WhatsApp. The company is also investing in AI research to develop new AR/VR experiences.

Data-Driven Marketing Platform: Meta’s advertising platform, Meta Audience Network, is leveraging AI to deliver targeted and personalized ads to users. This data-driven approach is driving growth in the advertising business.

Large and Engaged User Base: Meta has a vast and engaged user base that provides valuable data for AI development and training. This user base is a crucial asset for Meta’s AI business.

Jio Finance:

India’s Largest Telecom Company: Jio Finance is backed by Reliance Jio, India’s largest telecom company with a vast customer base. This strong customer base provides a foundation for Jio Finance’s AI-powered financial services.

AI-Powered Fraud Detection and Risk Management: Jio Finance is using AI to detect and prevent fraud, such as financial scams and identity theft. AI is also being used to assess credit risk and manage customer relationships.

Partnerships with Fintech Startups: Jio Finance is partnering with fintech startups to bring innovative AI-powered financial solutions to the Indian market. These partnerships are accelerating the company’s growth and innovation.

Key takeaways

- AI is a powerful technology that is disrupting many industries.

- There are a number of companies that are well-positioned to benefit from the growth of AI.

- Investors should consider investing in AI stocks as part of a diversified portfolio.

References

This video by Akshat Shrivastava discusses the power of AI and how it is disrupting the business world. He provides his estimate of which companies are going to dominate the AI space in India and across the world. He also gives some tips on how to invest in AI stocks.