Table of Contents

ToggleIntroduction

The financial industry is undergoing a seismic shift, driven by the rapid adoption of artificial intelligence (AI). This transformative technology is revolutionizing the way financial institutions operate, interact with customers, and make decisions. AI is not just a buzzword or a fad; it’s a fundamental force reshaping the very essence of our lives.

AI-Powered Automation: Streamlining Operations and Enhancing Efficiency

In the bustling world of finance, time is money. Manual tasks, repetitive processes, and data-heavy workflows can bog down operations, limiting efficiency and hindering innovation. AI is stepping in to streamline these processes, freeing up human capital to focus on more strategic endeavors.

AI-powered automation is a game-changer, automating mundane tasks that were once exclusively handled by humans. Customer onboarding, account opening, and payment processing are just a few examples of areas where AI is streamlining operations. AI algorithms can handle vast amounts of data with incredible accuracy and speed, reducing errors and fraud while expediting transactions.

AI-Driven Decision-Making: Unveiling Insights and Navigating Risks

The financial world is a complex landscape, fraught with risks and uncertainties. Making informed decisions requires a deep understanding of market trends, customer behaviors, and economic indicators. AI is empowering financial institutions to harness the power of data and analytics, providing a clearer picture of the financial landscape.

AI algorithms can analyze massive datasets, identifying patterns, trends, and correlations that would be imperceptible to the human eye. This enhanced data-driven decision-making is leading to more informed investment strategies, improved credit risk assessments, and smarter financial planning.

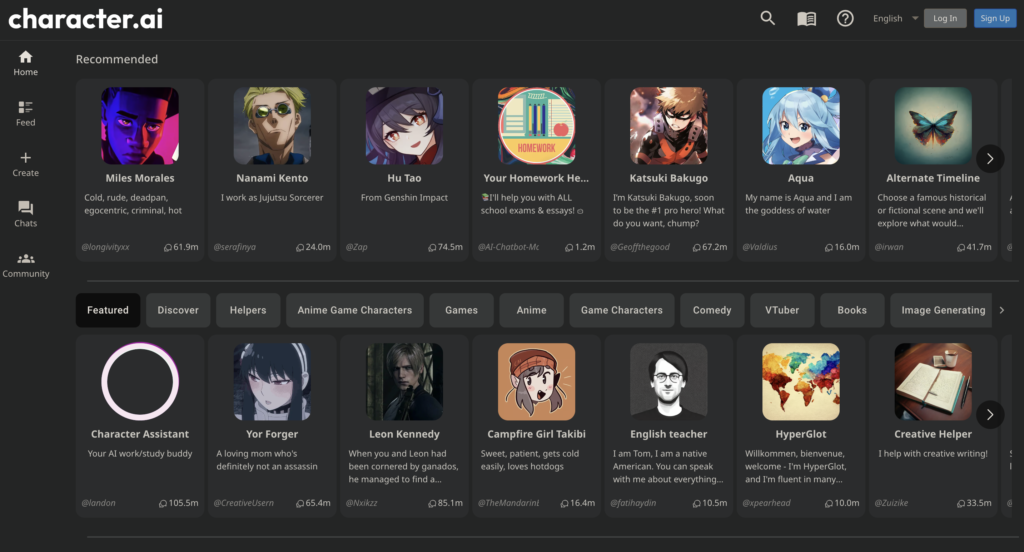

Personalized Customer Experiences: Tailored Solutions and Enhanced Engagement

In today’s customer-centric era, financial institutions are striving to provide personalized experiences that meet the unique needs of each individual. AI is proving to be an invaluable tool in this endeavor, enabling institutions to tailor products, services, and interactions to each customer’s specific profile.

AI-powered chatbots and virtual assistants are providing 24/7 customer support, answering questions, resolving issues, and offering personalized recommendations. AI is also enabling institutions to analyze customer behavior, preferences, and spending patterns to provide tailored financial advice, targeted promotions, and personalized mobile banking experiences.

The Ethical Landscape of AI in Finance

AI is undoubtedly revolutionizing the financial industry, but its transformative power comes with the responsibility of ensuring ethical and responsible implementation. As AI algorithms become more sophisticated, it is crucial to address potential biases, ensure fairness, and safeguard privacy.

Financial institutions must adopt ethical guidelines and establish robust oversight mechanisms to ensure that AI is used responsibly and ethically. Transparency, accountability, and human oversight are essential to prevent unintended consequences and maintain public trust in AI-driven financial systems.